A Body Corporate's Financial Position: How Can You Tell if it's Healthy or Not?

When looking at an apartment, one of the most important things to check is the financial position of the Body Corporate.

Does the Body Corporate have enough money to look after the building?

Does it have money for future maintenance and improvements?

Is it even looking after the building at present?

SUMMARY:

If a Body Corporate is falling short, money wise, when you compare the financials to the Long Term Maintenance Plan, it means the Body Corporate doesn’t see maintenance of the building as something that is important.

An unmaintained building leads to issues, leaks and big bills. If you don’t look after a building it falls apart.

This will then lead to more money needing to be raised. It may result in Body Corporate levies sky rocketing or special levies introduced, which will affect the value of your investment negatively.

So what do you need to look at?

1) The Long Term Maintenance Plan

2) The current financial position – Balance Sheet

3) Contingency Fund and Long Term Maintenance Fund

4) The approved budget for the year

What do you need to do?

You need to look at the Long Term Maintenance Plan which should have been created by an external professional; make sure it is being followed and that the money is there to look after the building in the future.

Below is a quick example of what to do.

1) Find out how much is needed to meet the Long Term Maintenance Plan (LTMP).

Now the funny thing is, yes a Body Corporate has to have a Long Term Maintenance plan, but there is a hole in the Unit Titles Act 2010 (May). It doesn’t have to be followed, so you need to make sure it is.

And that is what we are going to do today. I'll show you how to make sure the Body Corporate you are looking at is healthy and following their LTMP (Long Term Maintenance Plan).

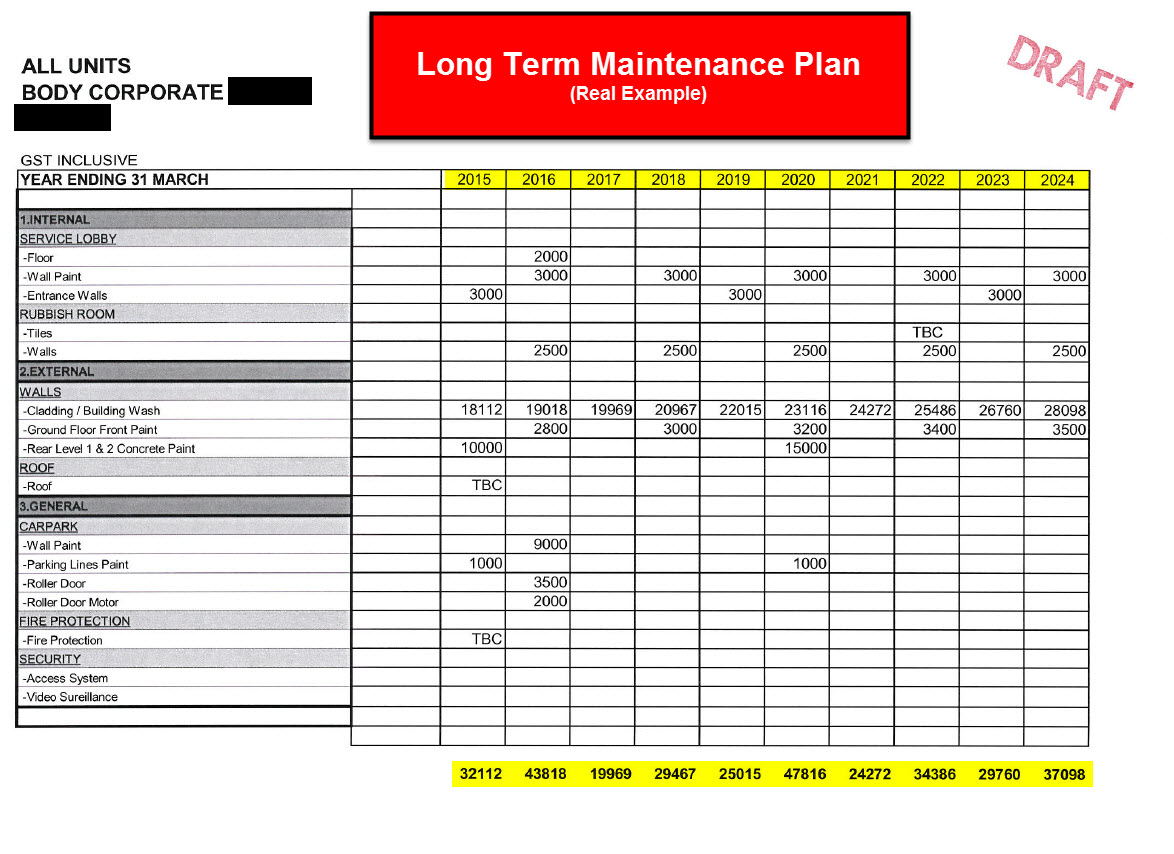

So in YELLOW, you can see the amount needed each year to make sure the building is looked after.

2) What is the FINANCIAL POSITION of the body corporate. Does it have the funds to meet the LTMP and is it raising more?

The next thing you are looking at is the Contingency Fund, which is often called the sinking fund (old terminology) and the LTMF (Long Term Maintenance Fund).

Now what is important here is not the individual amounts but the total as most Body Corporates keep the majority of their Long Term Maintenance Funds in the Contingency Fund due to allocation reasons.

You are then going to compare it to the Long Term Maintenance Plan

So far this building checks out.

It has a surplus of $70,000; and so more than enough for this years expenditure need of $32,112.

But what about the next year and the next.

3) Is the Body Corporate putting aside enough money for the maintenance required for the future?

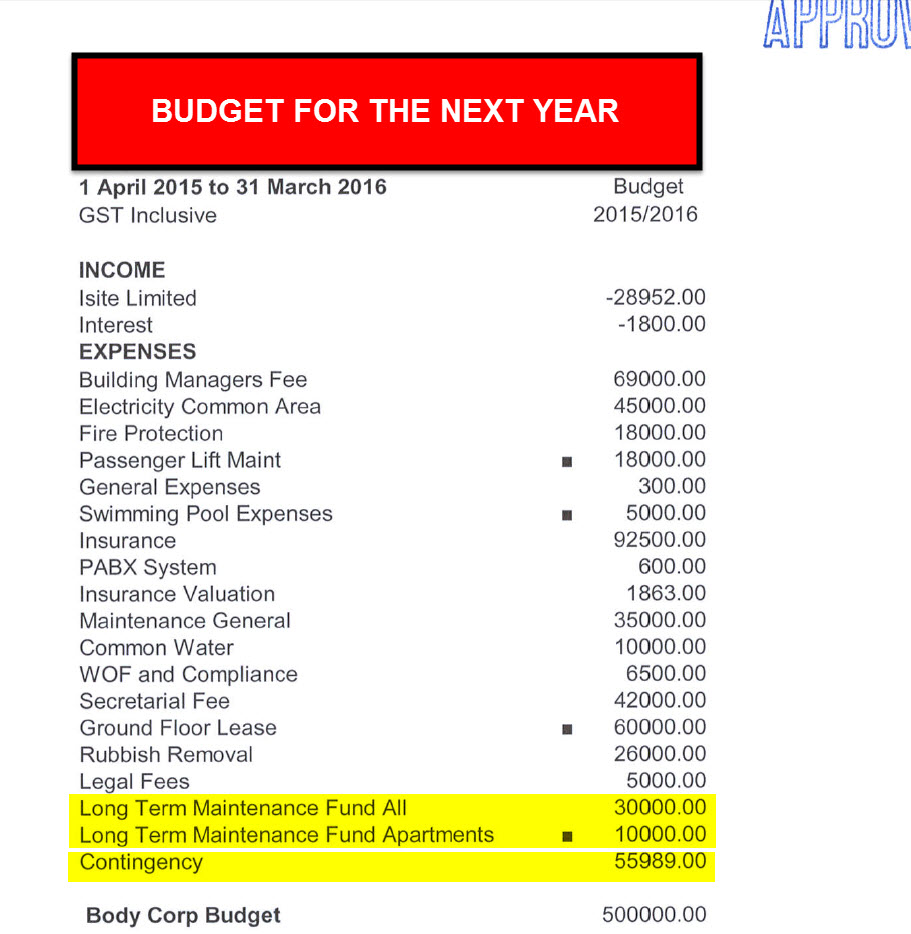

Here you can see $40,000 being raised each year in the budget specifically for the Long Term Maintenance Plan as well as an extra $55,000 to build up a reserve.

According to the Minutes, the Body Corporate are building up a reserve just in case something unexpected happens like a lift breaking down and for the Body Corporate to be more proactive by not just maintaining but improving the building i.e. they are looking at getting a designer to radically improve the common areas to increase values.

You can see here the Body Corporate is in good shape and is on it’s way to being in very good shape. It tells you the Body Corporate are committed to raising the values of the apartments as well as the standard of living of all those who live in the complex.

Now this is not always the case, but hopefully this has helped you understand what you need to look at when purchasing an apartment.

TRANSCRIPTION:

Good day, Andrew Murray here from Apartment Specialist, talking about how to find out if the body corporate you're looking at is healthy. Now, this is something that is extremely important, but very very few purchasers do. And I know this because I'm obviously selling apartments all the time. What I'm going to be talking about today is, firstly checking the financial position of the body corporate.

How much money they have, their liabilities and their assets? Does the body corporate have enough money to cover the maintenance and what needs to be done to the building to keep it in really good shape moving forward? Are they actually looking after the building? Is it actually being proactive and following what's called a long-term maintenance plan?

Every building has to have a long-term maintenance plan, which is enforced by the Unit Title Act that was set in 2010. Yet under this act, you don't actually have to follow it, so it's a bit of a loophole. So as a purchaser you really need to know this. In front of you is a long-term maintenance plan, but firstly, why should you care? Why does it matter? Most people just say, "Look through the body corporate minutes and make sure it doesn't leak."

Well you should care because if the long-term maintenance plan isn't being followed, that tells you that the body corporate doesn't care about the maintenance of the building. A building that is not maintained well will have issues, just like a house that's not maintained well. It'll be more likely to leak, and more likely to have problems which will cost you money and lead to high body corporate fees or have a leaky building, and there goes your investment.

What I'm going to do is show you today, how you actually check how healthy an apartment body corporate is. I'm going to start here with a long-term maintenance plan. Here you can see by law that you have to have one that does at least ten years in advance. You can see up here, you've got the years, 2015 right through to 2024. Also, you've got all the things that need to be done, wall paint, entrance walls need to be done, cladding, building washing and so on.

You've got the total amounts, and here you can see it's $32112 need to be spent in the 2015- 2016. In 2016 it's $43000 and what we're going to be doing is checking that these amounts are actually going to be. First, they're there and the works being done, and secondly the money's been set and being raised for the future. if we look at the next one I've got here which is next we're looking at obviously the balance sheet.

What are the assets here? You can see here you have a total equity of $80000 last year and $138000 this year. So that tells you that the body corporate's financial position is increasing. That is very good. Now what you need to then check is, it's increasing because:

a) are they doing nothing

b) they're putting a lot aside money

They're putting aside more than they need, which is what you want them to be doing. In this case they are actually doing the work, which is good. So that shows you're in a very good position. Next, you're looking at obviously the contingency fund and the long-term maintenance fund. These are actually all the same thing. A contingency fund, you may have heard of what's called is a sinking fund. It's the same thing, the sinking fund is the old fashioned terminology, the contingency fund is the new.

The long-term maintenance plan here, is a long-term maintenance fund. You actually add these all together and it comes to around about you're looking at probably close to $75000, which that's how much money's been put in just this next year's budget, towards obviously looking after the building, which is very good. Because if you match it back to what we were looking at before, which is this amount, is easily enough to cover that $32000 for this year, and some extra to be building up the contingency fund for the future.

Now we need to look at the budget. So this is where we're looking at what's happening, we've got enough money now. This building and as you said, it's in a position of one hundred and whatever it was thousand dollars. But what happens in the future? If you spend money each year, you're decreasing these funds, you need to make sure that the budget is being set to increase, otherwise your body corporate levies are going to need to be increased in the future.

And here you can see they're putting away $30000 each year plus another $10000, so $40000 just to the long-term maintenance fund, and on top of this another $55000, basically $56000 towards the contingency fund - this is all one thing. They're spending $32000-$33000, which is pretty much this amount here, but they're actually increasing their contingency fund by another $55000.

What that means is they're building up more money. If you read through the minutes of this body corporate, they're doing this because they want to have money in reserve for what if something happens that wasn't expected, for example the lift breaks down. But what they're actually doing is looking at not just maintaining the building but improving it, and that's a really the key that you want to look in the body corporate.

What they're doing here is they're looking at getting a designer in and redesigning all the interior, all the common areas to make it look-- basically they're raising the values and make a better living experience for the others. Which is fantastic. More and more, you can see here, I'll just go through it again very briefly. You're looking at the long-term maintenance plan.

You're looking at how much is needed, are there any big amounts here, these are all pretty constant, the highest tenure is $37000. Not all buildings are like this, you might have one where the roof needs to be replaced, and you've got $100000 here, so you need to make sure that money's being put aside for that. Secondly, you're going to the balance sheet to see that body corporate position, you can see that $138000 in the red, which is great, and then obviously their net assets.

They've got quite a bit of money already at the moment in the contingency fund and the long-term maintenance plan. Then what you're doing is you're looking to the future and going, what are they doing now? What's my body corporate levy doing now? What it's doing is of course all the things that are being spent here.

You can see swimming pool expenses, you can see a building wash in here, which is telling you it's being looked after, plus extra money's being raised out of your levy already being paid.Which is great news. So this is a very healthy body corporate, and it's a good one but it's just going to get better and better. Hope that helps.

If you have any questions, flick me an email at [email protected] or call +6421 424 892 and I’ll be happy to help you with your queries.

Cheers.