Market rents are higher than everyone thinks

Market Update

Market rents are higher than everyone thinks

Market Update - August 2023

August 2023

The correct reporting of market rental levels for apartments is crucial due to its significant impact on the property's value, and current reports are inaccurate.

More than houses, what an apartment rents for matters. Rental income is a huge factor that influences the value of an apartment and more so than central houses, due to the higher investor purchaser percentage.

So to say it's important that market rent facts and figures are reported correctly is an understatement.

Yet right now, market rental levels being reported are way off. Yip, the whole industry...and it's having all kinds of consequences.

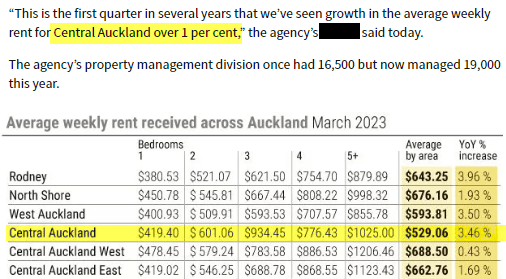

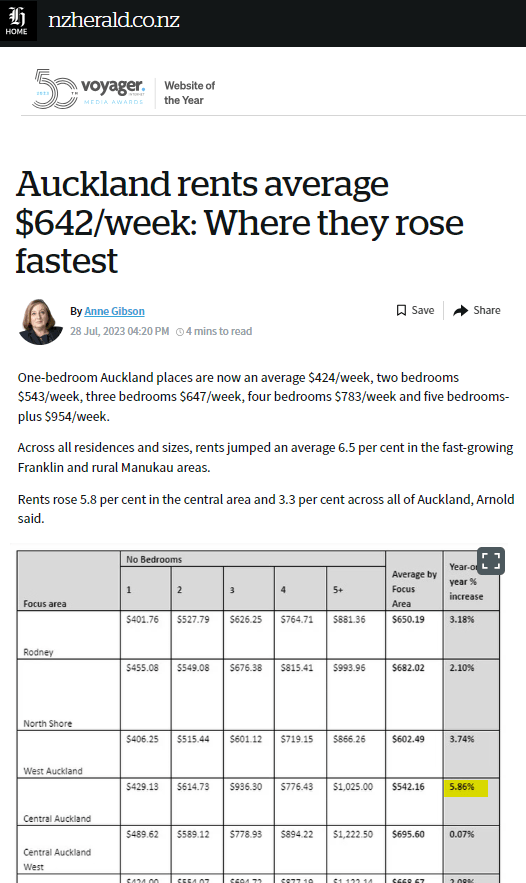

The problem is that reporting methods align with our rental market's more normal meandering behaviour, not one bouncing back from a world pandemic. For example, Apartment City and Fringe apartment rents are being underreported as only having moved 2 to 5.6% in the last 12 months (depending on the organisation you talk to).

Now I watch and record every rent achieved in every complex daily. Studios, one-bedrooms, two-bedrooms... them all and the central rental market has exploded this year, with market rents over the last 12 months increasing around 20%

So the rental industry is really missing the mark here. What makes it worse is they release their information to the papers resulting in this completely incorrect narrative, then sold to the public as reality. And yes, that means apartment buyers.

Typical Example: New Zealand Herald reported a 1% and a 3.46% increase in rental prices in March this year.

Firstly how come the stats are so wrong? Rental companies can't miss the mark that much..can they?

Well, they are, and it's because of something I call sticky rents. You see, rental companies report the average rent over their book (all their rentals). They do this by taking all the rent their organisation receives, adding them up, and dividing it by the number of apartments they look after. Sounds simple enough. But it's too simple, and that's the problem.

Tenants sign leases for a year or longer, and when they do, they lock in the rental price. This is the complete opposite of, say, the price of vegetables, which you see all going up weekly as you go to the grocer.

For example, if a rental company has one hundred 2-bedroom apartments on its books and, let's say, for ease of calculation, all rent for $500 per week - Resulting in the average rent being $500 per week.

The market rent then rises by one hundred dollars in one month (20%) to $600 per week. The apartments don't all start renting for $600 per week. Only very few tenants decide to move out and are re-rented. This results in the rental company's average rental price being only marginally above $500 as most are still renting for old market levels. Nowhere near the average $600 actual market level.

Let's do the numbers to show you how in the dark this is.

Situation

- 100 apartments rented for $500 p/w rent by XYZ agency.

- Market rent increases by 20% or $100 to $600 p/w

- 10/100 apartments in one month come up for rent.

- 10/100 apartments rent for $600 p/w

- 90/100 remaining apartments are still renting for $500p/w

New reported average rent: (10 x $600) + (90 x $500) / 100

= $510 or a 2% increase

I would read this and think I should be renting my apartment for $510...maybe push it to $520p/w. Not the correct $600 or 20% increase in rents.

This is what is happening right now. They should be only measuring new rent achieved vs old rent achieved.

See how powerful this wrong message being communicated is.

The rise right now being reported is a fraction of what's actually going on. The Average rents being achieved are well below what's actually being achieved.

The result is under-rented apartments, buyers not knowing what market rent is and huge frustration for us as agents as we debate this with buyers to raise values.

Building example:

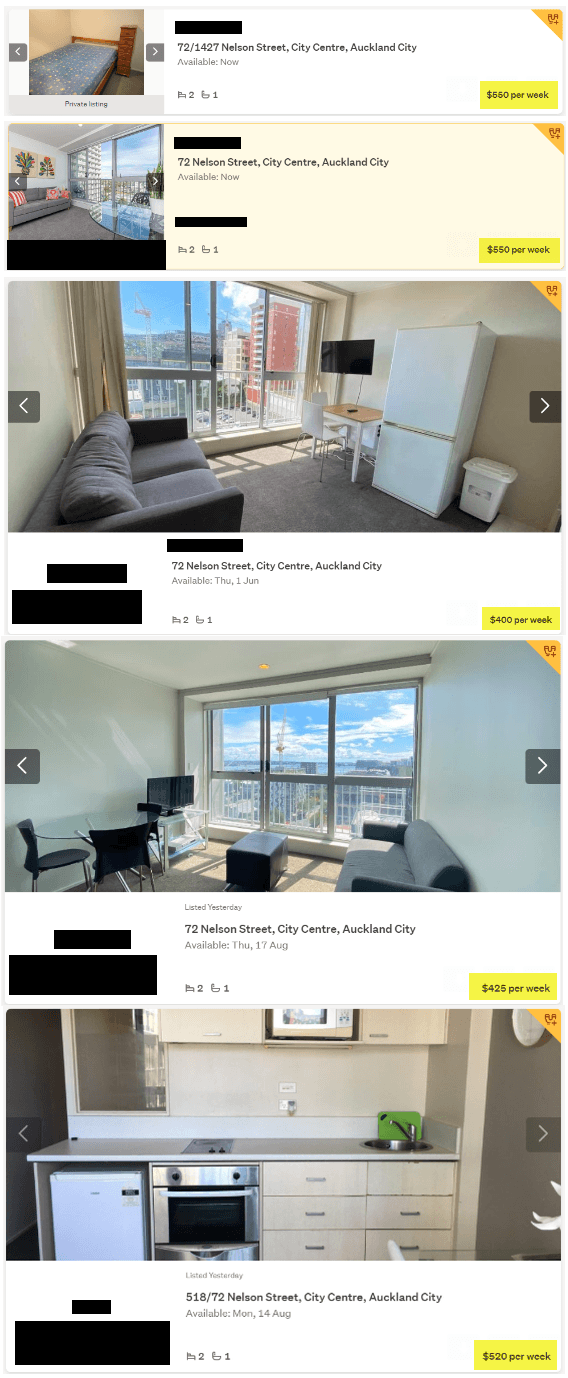

Although you may own a much nicer apartment due to its large number of almost identical units, this building is a great example of the disconnect.

All these apartments on Trademe are in the same building, have exactly the same layout, and are the same size, with the only difference being the condition and height in the building.

The size of the ad difference is due to the amount paid for marketing by the owner and all logos and names are blacked out as this is not about pointing fingers.

See the difference. It is huge, and if you have doubts, I can send you many more examples from other buildings.

So the positive and why I am communicating this.

The first reason to make you aware is that even though your rental agent (and we don't do rentals remember, so we aren't trying to get your business) may be doing a great job but due to, agency leadership may not be aware of the huge change in market rents. So please check on Trademe, or send me an email for a quick rental check. It's free and easy as I know all the floor plans, so you don't need to disturb your tenants.

The second is to give you all confidence and re-emphasise that the Auckland Apartment market is a recoiling spring ready to rise when those interest rates drop next year and the year after. The good news does lie ahead.

Next Month...the election is coming, so what do we expect the effect will be on apartment values.

And as always...